Here to help your team, while earning and keeping your trust

The HR & Group Benefit Solution Source

You have questions, we have answers

You need a partner with the resources to help you address your People Operations challenges. Benefits Quarterback was created to be that partner. Questions our clients ask include:

What types of accommodations do I have to make for employees with disabilities?

A reasonable accommodation is a modification or adjustment to a job or the work environment that enables a qualified applicant or employee with a disability to participate in the application process or perform essential job functions.

Are we allowed to require a drug test before making an employment offer?

Drug and alcohol testing for candidates and employees is regulated at the federal level by the Drug-free Workplace Act (DFWA), the Americans with Disabilities Act (ADA), the Fair Credit Reporting Act (FRCA) and U.S. Department of Transportation regulations. Many states also regulate workplace drug screening policies. Pre-employment testing must be conducted consistently to either all candidates or just to all candidates in safety-sensitive positions. Tests should be conducted after a contingent offer of employment has been extended

What are the rules for Form I-9? Do all employees need to complete one?

The Employment Eligibility Verification form, or Form I-9, must be on file for every employee who was hired after Nov. 6, 1986. When an employee is hired, he or she should complete Section 1 of Form I-9. The employer must complete Section 2 of the form within three days of the date of hire.

How does HIPAA distinguish Wellness Programs?

HIPAA divides wellness programs into two categories: Participatory and Health Contingent. Participatory programs do not require individuals to meet a health-related standard to obtain a reward (or they do not provide a reward at all. Health-contingent programs require individuals to satisfy a health-related standard to qualify for a reward.

How long are qualified beneficiaries entitled to COBRA when Medicare enrollment is involved?

When the qualifying event is the end of employment or reduction of the employee’s hours and the employee became entitled to Medicare less than 18 months before the qualifying event, COBRA coverage for the employee’s spouse and dependents can last up to 36 months after the date the employee became entitled to Medicare.

Are there specific non-discrimination rules that apply to self-funded plans?

Yes. Internal Revenue Code (Code) Section 105(h) contains nondiscrimination rules for self-insured health plans. Under these rules, self-insured health plans cannot discriminate in favor of highly compensated individuals (HCIs) with respect to eligibility or benefits.

Your Benefits Quarterback

Not finding the answers you need?

Let's discuss your challenges and goals

We are here to help, and look forward to hearing from you.

Hampton & Benefits Quarterback

Navigating the field with you

Benefits Quarterback is here to be your trusted partner, and help you manage the complex worlds of Health & Welfare benefits and HR Technology.

Hampton & Benefits Quarterback

We’ll admit it, we’re Benefit & HR geeks. Obsessed with savings and efficiency? Maybe…but to your benefit.

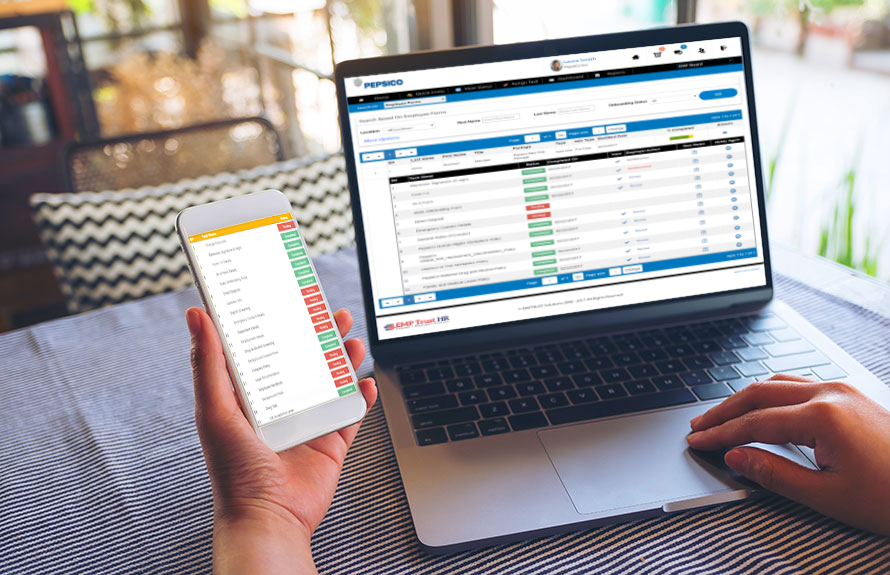

Multiple People Operations platforms?

A single sign on dashboard can put all your technology in one place for easy access.

Have your plans grown with you?

Is it time to evaluate some alternate funding approaches? Is self-funding right for your organization?

info@benefitsqb.com | 215-897-9010 | Hampton Consulting Corporation. All Rights Reserved. Design by Creative MMS